Consolidated life of mine plan for the Syama gold mine in Mali and the Mako gold mine in Senegal have been released.

Resolute Mining Ltd’s CEO, Stuart Gale announced that the latest LOM plan reflect an improved production profile over the current 12-year mine life at Syama incorporating the successful exploration campaigns which have extended oxide production for an additional two years together with exceptional drilling results at Tabakoroni. This will allow the firm to defer the development of the Tabakoroni sulfide mine as they continue to assess and optimise the plan for the development of this resource.

“Syama has a significant gold endowment and there is still a great deal of exploration to be undertaken in this area. We remain very confident that the Syama operations will continue developing and extending beyond what we have published today. In addition, we remain focused on identifying further extension and development opportunities at Mako in Senegal, where we also expect to extend our mining activities beyond the current mine life,” said the CEO.

Syama LOM plan

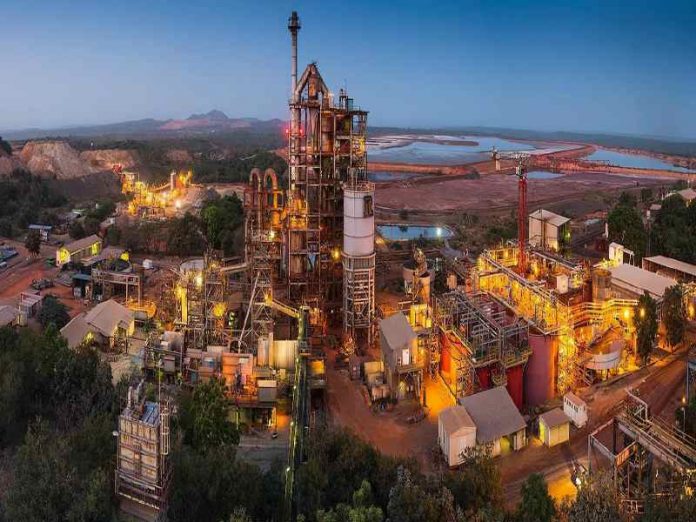

Syama is a large-scale operation currently comprising an underground mine and opencast satellite mines providing ore to two separate processing circuits: a 2.4 million tpy sulgide processing circuit and a 1.5 million tpy oxide processing circuit.

A pre-feasibility study for an underground mine at Tabakoroni was completed in 2020. It is intended that Tabakoroni sulfides will sustain Syama’s annual production between 250 – 300 000 oz until 2030, as oxide operations cease. Exploration success at Tabakoroni has resulted in reserves increasing to 5 million t at 4.7 g/t for 0.77 million oz while resources have increased by 40% to 9.2 million t at 4.4 g/t for 1.35 million oz . In light of the ongoing exploration success, Resolute continues to optimise plans for the development of the Tabakoroni sulfide.

Mako LOM plan

The Mako LOM production of 607 000 oz remains largely unchanged from the April 2021 LOM. AISC/oz is expected to be approximately 12% higher over the LOM. This increase reflects updated modelling of the cost base in the latter years of the mine life, where mining extends deeper into the pit and the haulage costs increase. In addition, the change in ore blend over time is expected to lead to increased processing costs.

Resolute notes that the above AISC/oz assumes the company is able to extend the tax exoneration it has received since the commencement of mining, for the remainder of the Mako LOM. As outlined in the company’s 4E preliminary financial statements, the company is currently in discussions with the Senegalese authorities regarding the extension of the tax exoneration from 5 – 7 years.

If the tax exoneration is not extended beyond five years, it is estimated that the LOM AISC/oz would increase from US$1071 – US$1145/oz, resulting from of the additional duties imposed. The company is firmly of the view that it has satisfied all relevant grounds for the exoneration extension to be granted, specifically the two year extension to the mine life.